Types of Planned Gifts

Charitable Bequests

Gifts of Appreciated Stocks

Life Income Gifts

Charitable Gift Annuities

Charitable Remainder Trusts

Life Insurance

Life Estate Gifts

Join the Perpetual Light Society

Charitable Bequests

A charitable bequest is gift given to your parish or school through one’s will. Charitable bequests can include anything of any value, such as cash, stock certificates, IRAs, life insurance, jewelry, real estate, antique furniture, etc. They are simplest way for people to remember those aspects of the Church that have impacted their lives the most. “Through a bequest,” according to Debra Ashton in The Complete Guide to Planned Giving, “individuals both of great wealth and of modest means can help to preserve or to create for the enjoyment of future generations an institution, a way of life, or an ideal which has had special meaning for them” (p. 216). Ashton estimates that 85% of all planned gifts come through bequests. See sample wording to leave a bequest in your will or trust.

Example: Bill and Mary Swanson have been members of St. Patrick Parish for forty years. They recently met with their attorney to prepare their will and do some basic estate planning. Prior to the meeting the Swanson’s discussed together which charitable organizations have been the most meaningful to them during their marriage and which deserved to be remembered with a bequest in their will. St. Patrick – where they were married, where their children were baptized, received first Reconciliation, first Eucharist, Confirmation, and where they experienced a loving community – came to mind first. They decided to include the following wording in their will:

“With thanksgiving for the faith we have received as members of St. Patrick, (city), Illinois, we bequeath the residuum of our estate to St. Patrick, after our outstanding obligations and family bequests are paid.” (Note: Please contact your attorney for various options of wording your bequest).

Gifts of Appreciated Stock

A very popular way to make a gift to your parish or school is through appreciated stock. This is true for several reasons: 1) stock gifts typically have less impact on the monthly budget; 2) you can deduct the fair market value of stock not what you paid for it; and 3) neither you nor the parish or school pays capital gains tax.

Example: Jim King is a member of St. Thomas parish. In December he received a brochure from the parish encouraging an end-of-year gift. He wants to help his parish, especially with their building drive. Part of his stock portfolio includes shares of Microsoft which have greatly appreciated over the last several years. He decides to transfer 75 shares of his stock to the parish account at a local broker. He pays no capital gains tax, receives a tax deduction for the current market value of the stock, and makes a larger gift than he could from his current income.

Life Income Gifts

Life income gifts are considered “gifts that give twice.” This is because they first pay you and then, upon your death, the balance goes to your parish or school. The two most common life income gifts are Charitable Gift Annuities and Charitable Remainder Trusts.

top of page

Charitable Gift Annuities

What is a Charitable Gift Annuity?

A Charitable Gift Annuity (CGA) is a contract between you and the Catholic Foundation for the People of the Diocese of Rockford, in which you transfer ownership of cash, securities or other assets, and receive a guaranteed fixed payment for life. Upon your death, the remainder of your gift is distributed to your parish, school, or other diocesan agency

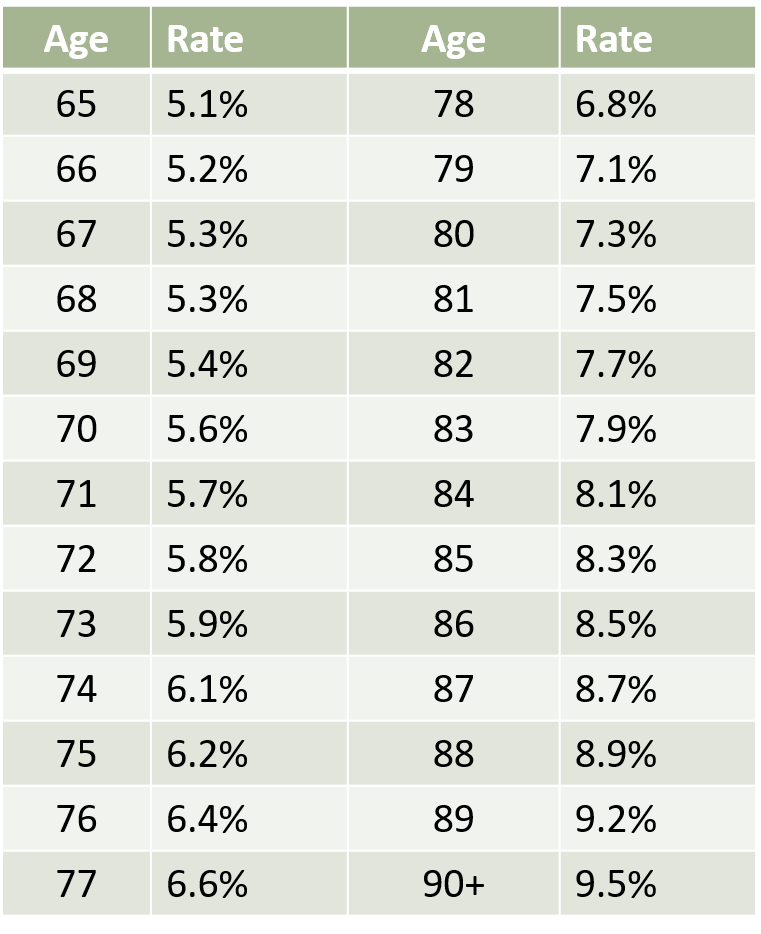

What are the current CGA rates?

The single life rates, determined by the American Council on Gift Annuities, are as follows (for joint life rates, which are a bit lower, please contact us):

ACGA rates effective July 1, 2018; minimum age 65; minimum amount: $5,000

What are some benefits of a CGA?

There are several, including:

- Rates of return that are normally higher than a bank;

- The satisfaction in knowing that your stewardship and gift-giving will eventually benefit your parish, school or diocese.

- Permanent, guaranteed fixed income for life, backed by the total assets of the Diocese of Rockford.

- A charitable income tax deduction upon creation of the gift as determined by the prevailing federal and state income tax regulations governing the original gift.

- If appreciated assets such as stock are used to fund the CGA, part of the capital gain tax is bypassed;

- No investment responsibilities or concerns.

Can I designate how the remainder is to be used?

Yes. Your gift can either be designated as an outright gift, or an endowed gift in the Catholic Foundation. For either choice you can restrict the gift for specific purposes or designate the gift as unrestricted to be used at the discretion of the entity receiving it. At least 50% of the remainder must go to a diocesan organization (parish, school or agency). The other 50% can be given directly to another charitable organization that does not provide goods and services contrary to Catholic moral teachings.

How much will it cost me to set up a CGA?

Nothing. This is a service provided by the Diocese, thanks to your generous support of Diocesan Stewardship.

How does the CGA Work?

Click here to see a sample illustration.

How do I establish a CGA?

Complete and send us a Annuity Single Life Application or Annuity Joint Life Application and we will return a confidential, personalized proposal for your review.

Example: George and Marilyn Murray attend St. Peter parish. They are both 70 years old and retired. They have a $20,000 CD maturing and would like to use it to make a gift to the school, which their children attended. They are not in a position to make an outright gift because they need the income that the $20,000 produces. They recently heard about the parish charitable gift annuity program which allows them to make a gift to the school and receive fixed payments for life. They each give $10,000 to the Catholic Foundation which will pay them 5.1%, or $510 per year until they pass away. Upon their death, the funds remaining in their accounts are transferred to the school.

Charitable Remainder Trusts

Charitable Remainder Trusts (CRTs) are similar to Charitable Gift Annuities in terms of “giving twice” but differ in several significant ways: 1) they are typically for more affluent donors ($100,000 minimum); 2) they are not administered by the Catholic Foundation; they require the services of agents of wealth – an attorney to set up the trust and a bank to administer it; 3) they are normally one part of sophisticated estate and tax planning; and 4) they are more flexible in terms of who receives the payment streams.

Example: Harold and Marie Johnson, members of St. Joseph Parish, are in their late 70s. They are working with a financial planner to produce an estate plan. Part of their portfolio is $500,000 worth of XYZ stock which currently pays a 2% dividend. They would like to make a large gift to their church but they would also like to supplement their income and help pay for their grandchildren’s education. They decide to establish a Charitable Remainder Trust with the XYZ stock which, for 10 years will pay them a 7% income (approximately $35,000 per year). After 10 years they would like each of their grandchildren to split the income equally until the last one graduates from high school. When that occurs, the balance of the trust will be given to St. Joseph Parish.

Life Insurance

There are two common ways you can use life insurance to make a gift. First, policies for which the original purpose is no longer applicable (college education for a child who has graduated), can be given to your parish or school. When you transfer the policy, you receive an immediate tax deduction. Upon your death, the death benefit of the policy will be given to the parish. (Note: if the policy is not paid up, the parish or school must decide whether or not to keep paying the premiums or cash in the policy.) Second, you can purchase new policies and name your parish or school as owner and beneficiary of the policy. According to the Practical Guide to Planned Giving: “If a donor would like to make a large gift on an installment plan, suggest that he or she talk with a life insurance agent about purchasing a new policy. By naming your [parish or school] as both beneficiary and owner of the policy, all the premiums could be claimed as a charitable deduction. Upon the insured’s death, your [parish or school] would receive an amount equal to the face value of the policy” (p. 24).

Life Estate Gifts

A life estate gift allows you to transfer ownership of your home (or vacation home, co-op, apartment) but retain the right to live in it for a period of years or until death. After the period of years or upon your death your parish or school becomes the owner of the real estate.

Example: Mr. and Mrs. Haines enter into an irrevocable agreement to deed their home, situated near the local nature center, to their parish on the condition that they would be able to continue living there for as long as either of them lived. They would continue to pay all the taxes, insurance, and other maintenance costs and would receive any income the property produced. The couple receive favorable federal income tax considerations at the time of the gift and possible other tax benefits.

You should always contact the Diocese prior to making a real estate gift. The Diocese has a Real Estate Acceptance Policy that it follows when considering accepting a real estate gift.

The Perpetual Light Society

Those who have remembered their parish, school, or other diocesan organization in their will or trust are encouraged to become members of the Perpetual Light Society. The society was created as a way for Bishop Malloy to recognize your good works and philanthropic intent.

Those who have remembered their parish, school, or other diocesan organization in their will or trust are encouraged to become members of the Perpetual Light Society. The society was created as a way for Bishop Malloy to recognize your good works and philanthropic intent.

If you have left the Church in your will and would like to be considered for membership, we invite you to call the Office of Charitable Giving at 815-399-4300 and request a PLS membership application.