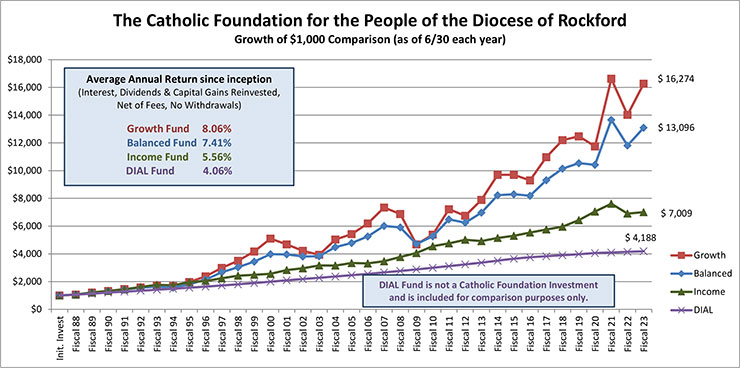

Performance Chart Fiscal Years 1988 – 2023

Types of Funds

Participants select from three options depending upon their investment needs and objectives. The three investment options are: The Growth Fund, The Income Fund, and The Balanced Fund. The three funds cover the spectrum of long term, short term, and intermediate investment strategies for capital growth and income.

| Growth | Income | Balanced | |

| Objective: | Long term growth of capital over time with a high tolerance for risk. | Maximize current income with modest risk. | Maximize capital appreciation with modest risk. |

| Investments: | Equity securities and cash equivalents. | Bonds, preferred securities and other income producing securities. | Equities, preferred, and a wide range of income producing securities. Currently allocation of the Fund’s assets is 70% Growth and 30% Income. |

| Investment Style: | Large cap, mid cap and small cap, international and emerging markets. | Bonds, preferred securities, covered call writing and other income producing securities. | Large cap, mid cap and small cap, international and emerging markets. Bonds, preferred securities, covered call writing and other income producing securities. |

| Return expectation: | Perform in line with the following: 1) similar allocated portfolio of unmanaged indices, 2) similarly allocated Foundations throughout the country, and 3) CPI plus 5%. | Perform in line with the following: 1) similar allocated portfolio of unmanaged indices, 2) CPI plus 2.5%. | Perform in line with the following 1) similar allocated portfolio of unmanaged indices, 2) similarly allocated Foundations throughout the country, and 3) CPI plus 4%. |

| Participant Profile: | You seek stock market growth potential and are willing to accept more risk in order to seek greater long-term rewards. | Your need is for current income. | You seek a combination of income and capital appreciation and are willing to forego some income in exchange for moderate growth of capital. |

| You are not looking for current income. | You are looking for higher income potential than currently available from Certificates of Deposit, Money Market Funds or Treasury Bills. | You like the flexibility of investing in stocks, bonds, and preferreds, seeking the greatest potential for reward. | |

| Time horizon is long term. | Time horizon is intermediate to long term. | ||

| You seek a portfolio that will serve as a hedge against inflation. | You are less willing to accept market risk. | You seek Income return with the added dimension of long-term growth. | |

| Exposure to foreign and domestic markets. | Seek income producing securities. | Diversification designed to help reduce risk and volatility. | |

| A portfolio with a diversity of investment styles including large cap value, mid-cap, small cap, international, and emerging. | A portfolio with a diversity of income producing investment styles. | Stocks and bonds, domestic and international equities, value and growth style investment management, and large and mid-cap equities. | |

| Full-time professional, independent portfolio management. | Full-time professional, independent portfolio management. | Full-time professional, independent portfolio management. |