What is a Charitable Gift Annuity?

A Charitable Gift Annuity (CGA) is a contract between you and the Catholic Foundation for the People of the Diocese of Rockford, in which you transfer ownership of cash, securities or other assets, and receive a guaranteed fixed payment for life. Upon your death, the remainder of your gift is distributed to your parish, school, or other diocesan agency.

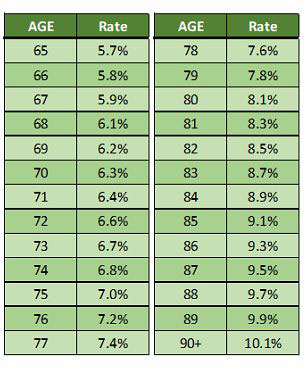

What are the current CGA rates?

The single life rates, determined by the American Council on Gift Annuities, are as follows (for joint life rates, which are a bit lower, please contact us):

ACGA rates effective January 1, 2024; minimum age 65; minimum amount: $5,000

What are some benefits of a CGA?

There are several, including:

- Rates of return that are normally higher than a bank;

- The satisfaction in knowing that your stewardship and gift-giving will eventually benefit your parish, school or diocese.

- Permanent, guaranteed fixed income for life, backed by the total assets of the Diocese of Rockford.

- A charitable income tax deduction upon creation of the gift as determined by the prevailing federal and state income tax regulations governing the original gift.

- If appreciated assets such as stock are used to fund the CGA, part of the capital gain tax is bypassed;

- No investment responsibilities or concerns.

Can I designate how the remainder is to be used?

Yes. Your gift can either be designated as an outright gift, or an endowed gift in the Catholic Foundation. For either choice you can restrict the gift for specific purposes or designate the gift as unrestricted to be used at the discretion of the entity receiving it. At least 50% of the remainder must go to a diocesan organization (parish, school or agency). The other 50% can be given directly to another charitable organization that does not provide goods and services contrary to Catholic moral teachings.

How much will it cost me to set up a CGA?

Nothing. This is a service provided by the Diocese, thanks to your generous support of Diocesan Stewardship.

How do I establish a CGA?

Complete and send us a Annuity Single Life Application or Annuity Joint Life Application and we will return a confidential, personalized proposal for your review.

Example: George and Marilyn Murray attend St. Peter parish. They are both 70 years old and retired. They have a $20,000 CD maturing and would like to use it to make a gift to the school, which their children attended. They are not in a position to make an outright gift because they need the income that the $20,000 produces. They recently heard about the parish charitable gift annuity program which allows them to make a gift to the school and receive fixed payments for life. They each give $10,000 to the Catholic Foundation which will pay them 5.9%, or $590 per year until they pass away. Upon their death, the funds remaining in their accounts are transferred to the school.